☀️ Good Tuesday morning, CryptoAM’ers! ☀️We’ll be back to your regularly scheduled programming this week, sorry if you’ve missed us.

For those of you in Chicago, we have a special event for you! Token Daily Capital & Fidelity are putting on a dinner, and you find the event linked here.

Bancor has a storied place in the history of cryptocurrency. The Bancor ICO was the largest ICO in history! They managed to raise $153M in June of 2017, $1M more than than infamous DAO ICO… (which itself led to the largest dispute in the history of Ethereum — the DAO hack).

Bancor is a liquidity protocol, aimed at creating a decentralized way to exchange and trade tokens. It launched its web application about 2 months after the close of its ICO, and has attracted a small but core group of traders who transact using the Bancor protocol regularly. Despite this core group of users, Bancor suffers from many of the same drawbracks that plague decentralized exchanges in general.

SBancor has also restricted U.S investors as other decentralized exchanges (such as EtherDelta), have been targeted by SEC for the unregistered selling of securities. The token price has fallen >90% from previous highs.

So needless to say, Bancor needed a facelift. Last week, they got one. Bancor revamped their token in a sweeping manner:

To accelerate and incentivize network liquidity, Bancor will airdrop BNT’s entire Ethereum reserve, which will amount to 10% of BNT’s market cap at the time of the airdrop, on all BNT holders.

BNT will be upgraded to an inflationary token with a default setting of 0%. BNT holders will vote on the rate of inflation and its recipients — deploying funds to strategic Bancor liquidity pools, oracles and developers, as determined by the community.

Let’s break this down a bit.

First, Bancor will be airdropping their entire BNT ether reserve (filled from their ICO days) to Bancor token holders.

Second, they’re introducing inflation into the Bancor system and redefining what it means to be a Bancor holder. In line with many other newer procotols, Bancor is introducing more forms of community governance into the system, and they are using inflation as an incentive to participate.

Third, they are focusing on something we’ve talked about before — ecosystem funds. Many protocols are beginning to realize that developers and companies are unlikely to begin building on a protocol without incentive. In order to introduce incentive, many protocols have spun up “ecosystem funds” that can pay devs to create on their protocol. Personally, I view a well run ecosystem fund as one of the most important secondary offerings a protocol should have.

Why this matters: Token models are ever changing. When the first Ethereum based ICOs launched a little more than 3 years ago, the concept of a “token” at the center of what is ostensibly an economic construct was a radical idea. Keep an eye on protocols that have the guts to radically overhaul their token system. Projects like Bancor, Numeraire and Haven (now Synthetix) stand out considerably.

We’ve discussed the topic of decentralized synthetics a few times here already. Decentralized protocols that allow for the creation of synthetic assets through collateralization are taking strides everyday, and those protocols are some of the most compelling use cases for decentralized finance I’ve seen yet.

Yesterday, UMA protocol announce a new product, the “Synthetic Token Builder”. This is essentially a more flexible and user controlled version of Synthetix. The concept behind the protocol is simple — allow users to use collateral to mint any type of token. For example, someone could mint a TSLA token using DAI as collateral, and sell it on a DEX. You could simulate the exposure to pretty much anything.

To ensure that tokens are fully collateralized at all times, UMA has implemented a practice of “freezing” assets:

At any time, anyone can ask the smart contract to check if your token facility is undercollateralized. During this process, the smart contract checks what the latest price is from the price feed and checks if the amount of DAI you’ve maintained in the contract meets the required amount.

If you do, you’re all set. If you don’t, the smart contract freezes all the collateral in the contract (you can’t deposit or withdraw), and assesses a penalty. Anyone who holds synthetic tokens that were minted by this token facility can redeem them for a proportional amount of the backing collateral, plus any penalty.

The obviously drawback: If the market moves violently, and the amount of capital needed to bring the token back to full collateralization is *more* than the amount already deposited, the token creator would be incentivized to walk away from the contact. In effect, this creates a upper and lower bound on the potential price gyrations, making it a less safe bet than a centralized exchange.

Yes, but: This is a great experiment! The product is now live on Rinkeby. It’ll be interesting to see how the UMA model (more open source, no token) competes with the Synthetix model (DeFi, but less open — does have a token). It seems as though the token aspect of Synthetix has attracted a lot of speculators, and I tend to believe that models like this work better with tokens because of the psyche of cryptocurrency market investors.

Go deeper: read the full UMA protocol announcement.

Yes, you read that headline correct. Last week at the CoinDesk Asia conference David Paul, a Marshall Islands Minister revealed that the Marshall Islands was planning on introducing a digital token to act as its national reserve currency. They’re even launched a nifty new website where you can register to buy the thing! They’ve named the new currency in an incredibly catchy and witty way: the Timed Release Monetary Issuance. Sounds good?

They plan to sell this currency over 18 - 24 months via a pre-sale.

Some key quotes from the conference as reported by CoinDesk:

The U.S. Treasury had told the RMI government “point-blank,” according to Paul, that it didn’t like the SOV. However, following nearly a year of internal discussions, Paul affirmed that U.S. officials are saying this project could work.

“A nation cannot rebrand [like a company can]. That’s why we have to do this in such a way that’s different. It has to be transparent. It has to be inclusive. We need to make sure that we work with regulators to ensure that once we launch, they don’t go back and say, ‘Oh, you haven’t done this. You should have done that.'” - David Paul

There were some big players that stood in opposition to this plan. According to a CoinDesk report, the IMF “advised against the currency” last year. U.S regulators were also uncomfortable with the idea, but ultimately turned foot and decided that the tender may actually end up working out.

Big picture: This may seem like a ploy by a smaller nation to capitalize on fundraising through tokens. Let’s be real — you’re probably right. With that being said, it’s indicative of a larger and interesting trend of countries introducing digital currencies into their ecosystem. It’s not unreasonable to assume that smaller, more economically fragile countries will look to digital tokens as a way to attract foreign investments.

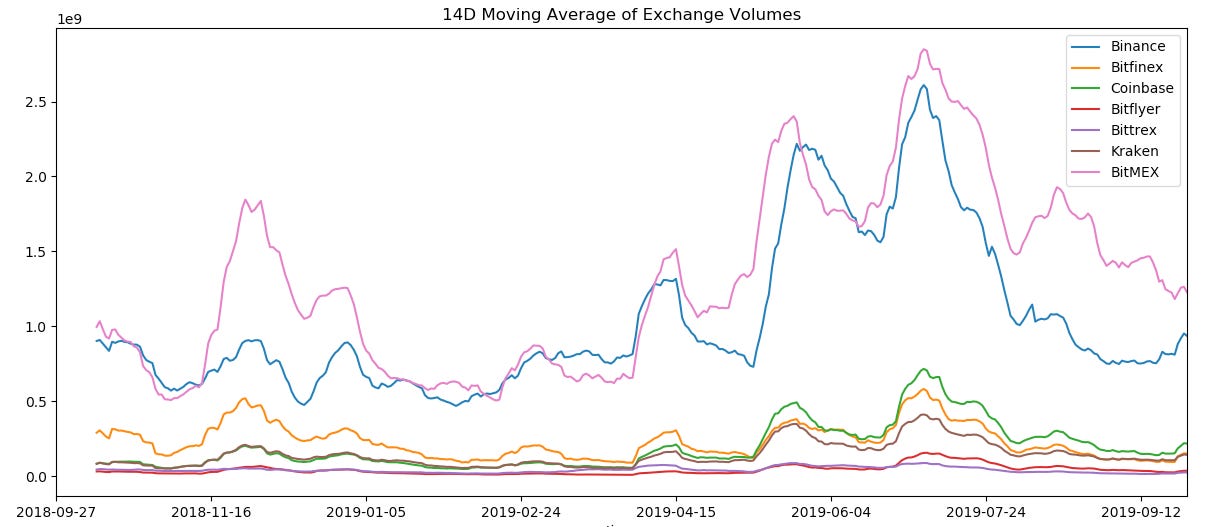

Overall Market: Both realized and implied Bitcoin volatility has dropped off significantly over the last week, and we’re seeing significant Bollinger Band and MA coiling as evidenced by the chart below. Based on those indicators, it’s likely in my opinion that we will experience an explosive. I tend to lean heavily on the reflexivity thesis, which would indicate that the first large candle out of this lull will dictate the next few weeks of price action. In light of these trends, although there is no guarantee, I would expect to see substantial movement.

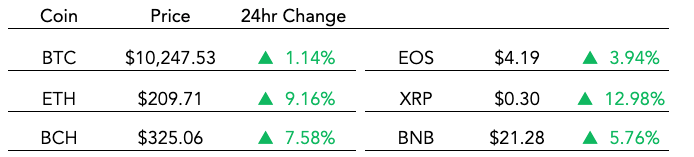

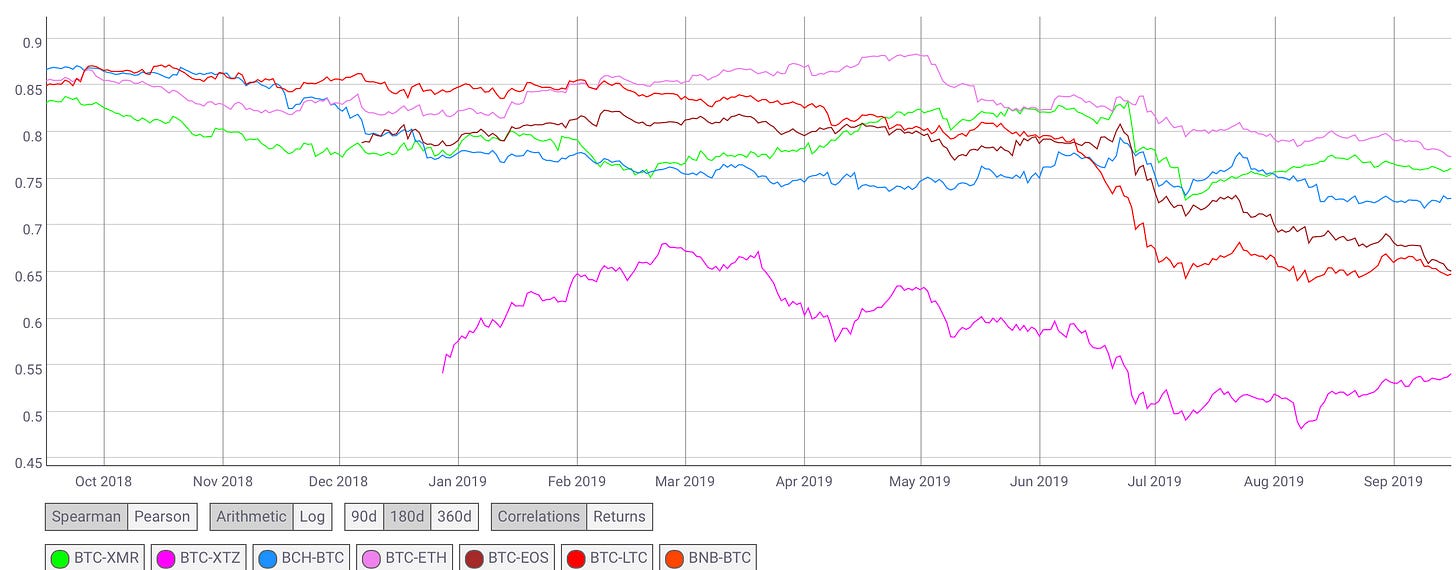

As you can see in the chart below, Bitcoin dominance has started to fall off after reaching a peak of 73.5%.

Based on the correlations breaking down, and a turning in BTC dominance, I am long select ALT-USD pairs that have shown bottoming patterns such as XRP and LTC. I am holding spot Bitcoin.

Key Support: 10100, 9880

Key Resistance: 10400, 10650

Sep 17, 2019 - Ethereum Classic Hardfork

Sep 18, 2019 - Binance will be opening registrations for Binance USA

Sep 23, 2019 - Bakkt to launch Daily/Monthly Futured

Sep 27, 2019 - CME futures contract expiry (3 mo)

Oct 13, 2019 - Bitwise ETF decision by SEC

Oct 14, 2019 - Extended date for Bitfinex to meet order and turn docs over to NYAG

What You Should Know Before Putting Half a Million DAI in Compound

Came across this tweet the other day about the significantly higher interest rates we see in DeFi:

Pretty bullish sentiment. One of the things that has always been on my mind though is the actual risk involved with these DeFi platforms. So it was interesting to see Ameen Soleimani, CEO of crypto’s beloved Spankchain, discuss what it was like managing the company’s finances and deciding whether or not to use Compound, one of the largest DeFi lending protocols.

Spankchain has about 500K of DAI in reserves, which at 10% interest rate on Compound has the potential to net around $4K a month, so there’s a good incentive to move that DAI onto Compound.

Ameen identifies three risks when lending on Compound:

Contract Security Risks

Centralized Points of Failure

Bank Run Risk

Contract Security Risk

Not a massive risk according to Ameen, given that Compound has had three different audit reports by three different smart contract security firms + an independent bug bounty program.

Centralized Points of Failure

This is where things get more interesting. According to the report:

Because all cTokens use the same administrator, if the administrator key is compromised, all assets deposited in Compound can be trivially drained.

Having this type of centralization allows Compound to more easily make upgrades to its protocol (e.g. V1 to V2), but does leave open the possibility that if the administrator key were to fall into the wrong hands, there could be major disruption. Also important to note obviously is that Compound itself has the ability to “upgrade the price feed oracle, upgrade the interest rate models, and upgrade the risk model of the protocol.”

Bank Run Risk

Perhaps the most interesting of all the risks. The key here is to know the utilization rate of a DeFi protocol, which is the amount of total assets in the protocol that are currently being borrowed versus the total amount of assets committed to the protocol.

E.g. If there was $100M worth of DAI inside the Compound protocol and $90M of that was being borrowed, the utilization ratio would be 90%.

The reason why this is interesting is at the end of July this year the utilization ratio on Compound hit close to 100%. In other words, if a large group of people wanted to withdraw their DAI from Compound at that time they wouldn’t have been able to - it was all being borrowed and the system didn’t have the DAI available to give back to these lenders. What this would look like, according to Ameen:

“Lenders attempting to withdraw would simply see their transactions fail, and would be forced to wait until more borrowers paid back their loans before they could withdraw.”

This is clearly a problem if you’ve lended out DAI and you quickly need to get this DAI back. Imagine putting your money in a bank or other financial institution and then, when trying to withdraw that money again, you’re told its not possible and that you’ll have to wait.

Your only other option would be to sell your cDAI (compound token representing DAI) on open exchanges, where you’re likely to get stuck with exchange fees and potentially lower prices if everyone is trying to sell their cDAI at once.

How Compound addresses this

In the case that the utilization rate gets close to 100%, the Compound protocol is supposed to increase interest rates to incentivize borrowers to repay their loans (or otherwise it gets increasingly expensive for these borrowers). Doing this also is supposed to incentivize more lending (which should also decrease the utilization ratio).

Here’s the problem. The maximum interest rate the Compound protocol can currently reach according to Ameen is 20%. Let’s not forget that to take out DAI, borrowers use Ether. If a borrower believes that ETH will increase by 20% over the course of the year, there’s no incentive to pay back that loan, which could leave Compound with a liquidity problem.

This problem could be avoided however because Compound has the ability to manually increase interest rates on the protocol if it wants to. However if you’re a borrower and you borrowed on the assumption that you would never pay more than 20%, then facing the prospect of rates higher than that is obviously going to leave you unhappy.

Overall

If you’re lending on Compound and you want to be able to withdraw your funds at any moment, you should carefully watch the utilization ratio. If it starts to tick towards 100% and the price of ETH is going upwards, I’d be considering my options to withdraw my DAI from the protocol. If not you’re relying on the hand of god (Compound) to arbitrarily lift interest rates for you - something that could lead to a whole lot of push back on Compound given the decentralized ethos of the crypto community.

If you got forwarded this edition, you can sign up below to get CryptoAM in your inbox bi-weekly.

The core focus of CryptoAM is to cut through the noise of the cryptocurrency world — and deliver actionable information straight to your inbox. Every piece of information that CryptoAM delivers ends with a “so what — why does this matter?”. It’s easy to get lost with all the information that comes out everyday, CryptoAM exists so you have a guide.

- Avi and Zac

CryptoAM was founded as a daily newsletter by Avi Felman in May 2018. Zac Thomas joined Avi in January 2019 to revamp CryptoAM and is now a co-writer for the letter. Zac will normally focus on policy, regulation and mainstream adoption while Avi generally writes the project, technology and market focused pieces. If you read closely, you’ll be able to pick us apart soon enough 🙂

Nothing written in CryptoAM is legal or investment advice and should not be taken as such. CryptoAM does not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence.